Warners Property Market Update - August 2018

Latest figures from the property market in Edinburgh and the Lothians reveal that, whilst conditions remains highly favourable for sellers, there have been further signs that the pressure being placed on buyers is now starting to ease.

Over the last 18 months majority of properties for sale in Edinburgh have sold quickly and for values that are well in excess of their Home Report valuation. During this period demand has consistently exceeded supply meaning that most properties have attracted multiple notes of interest. This has allowed many sellers to set closing dates at which stage buyers will generally put forward their best offer for the property if they wish to secure it, leading to homes selling for substantially more than their original valuation.

As we revealed last month however, there are signs that the excess of demand over supply has started to ease somewhat meaning that the average premium that properties achieved over Home Report valuation, while still high, was below levels observed at the same time last year. This pattern has continued.

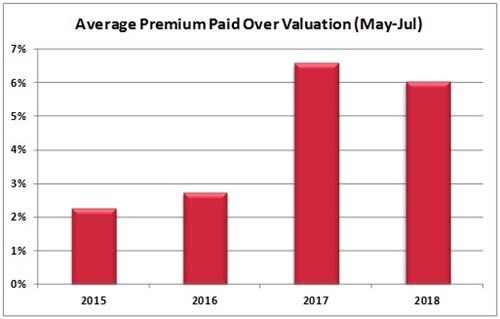

In the three months ending July this year, the average premium paid over the Home Report valuation stood at 6.0%. That represents a drop from 6.6% during the same period in 2017.

David Marshall, Operations Director with Warners commented: “Since the start of 2017 the housing market across much of Edinburgh and the Lothians has suffered from a lack of properties coming onto the market. Many potential sellers have delayed putting their property onto the market until they find a property that they wish to buy. This has led to a situation where the number of active buyers far exceeds the number of homes available for sale.

"Since the beginning of the summer period however we have begun to see more properties coming onto the market, easing the pressure on buyers and bringing the average premium required to secure a home down. That will be welcome news to buyers, especially given that lenders will only lend up to the valuation of a property, meaning that anything that you bid above that figure is money that you will need to have available upfront in addition to your deposit.

"Although conditions have improved for sellers it is worth putting the recent decline in premiums into perspective. The average premium that properties are achieving above the Home Report valuation is still very high by historical standards. Two years ago the average premium being paid was 2.7% and in 2015 the figure stood at just 2.3%."

David Marshall concluded: “It is still a market in which sellers hold sway but with more properties coming up for sale, we expect to continue to see better balance in the market as we head towards the end of 2018.”

If you have a question about the property market or if you are thinking of buying or selling a property, get in touch with Warners today on 0131 667 0232 or by emailing us at property@warnersllp.com and one of our friendly, expert team will be delighted to help.

< Back