Scottish Property Tax Changes as LBTT Introduced

The changes to the new tax that will replace Stamp Duty will no doubt have confused many buyers and sellers – not least as the revisions announced by MSP John Swinney yesterday (Jan 21) come after the tax itself was unveiled only in October and it won’t come into effect until this April.

So the simple question being asked by anyone with an interest in the property market is – how will this affect me?

In short, the revisions to the so-called Land and Building Transaction Tax (LBTT) has created more winners than losers in Scotland.

But, as with any tax, it will affect households in different ways.

The first thing to highlight is that the tax is progressive – that means you don’t pay the applicable rate on the full price (as you did in the old system). So, although the rates are higher, most people will pay less in the new system.

With the average property price in Scotland sitting at around £160,000, it means the majority of the population are winners. Also, with the changes announced yesterday, more than 90% of house movers will pay less than was originally proposed.

In addition people in Scotland buying a property up to £333,000 from 1 April, will pay less than they currently do and less than those in the rest of the UK.

However, there will be losers. Those buying high end properties, the majority of which are in Scotland’s major cities, will pay more. Some of the middle earners within the cities will still be squeezed – though, with the rates announced on Jan 21, they will be squeezed less than they were going to be.

The one area that may cause a more than a ripple of disquiet is that those buying a property above £325,000 in Scotland, will pay more in stamp duty in Scotland than in England.

Here’s how Scotland will now differ from England:

|

Scotland |

Rest of the UK |

|

Up to £145,000: 0% |

Up to £125,000: 0% |

|

£145,000 - £250,000: 2% |

£125,000.01 - £250,000: 2% |

|

£250,000.01 - £325,000: 5% |

£250,000.01 - £925,000: 5% |

|

£325,000.01 - £750,000: 10% |

£925,000.01 - £1,500,000: 10% |

|

£750,000.01: 12% |

£1,500,000.01: 12% |

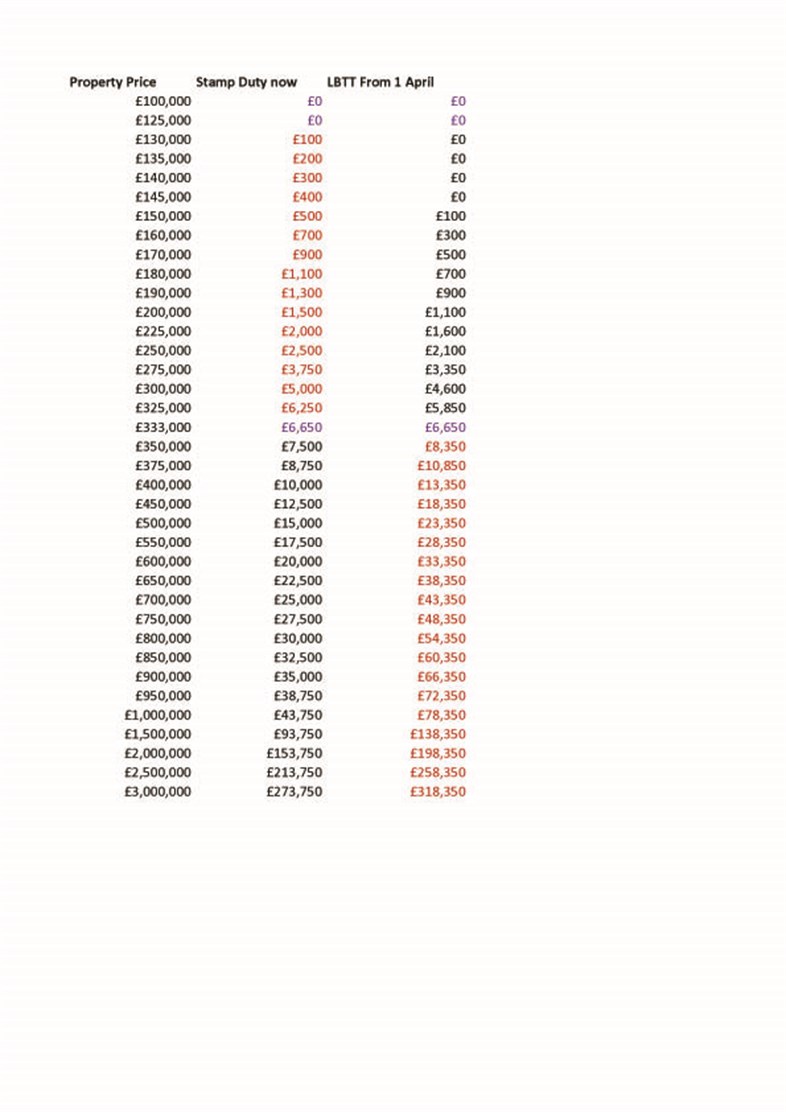

But perhaps of most value is this table below which shows what someone will pay now and also what they will pay from 1 April in Scotland.

The figures in red show where you will pay more – so at the lower end of the property market you will pay more now, the higher end you pay more from 1 April.

As I said, with this announcement, there are more winners than losers - and those at the lower price range are helped the most which helps the property market and the economy as a whole. We need people to be able to buy their first homes to let others buy further up the ladder.

Of course, what, we as estate agents, cannot know for sure is how buyers and sellers will react? Will there be a rush for those buying for more than £333,000 to complete before 1 April? And conversely, what will those buying for less than £333,000, who are better off after 1 April, do?

Keep reading our regular blogs for the best analysis of the property market in the Edinburgh and Lothians for the expert advice you need to buy and sell your home.

Property Price Stamp Duty now LBTT From 1 April