Is the Government Considering a Rethink on Property Tax?

In April 2015 Stamp Duty – the tax you pay when buying a property – was replaced in Scotland by Land & Buildings Transaction Tax (LBTT). A year later the tax was amended to include the Additional Dwelling Supplement (ADS), which essentially saw an additional 3% tax being added where the purchaser already owned another property.

Recently, however, there have been rumblings that the Government is considering revisiting the tax once more with a view to changing the bands. So, what’s behind the possible rethink and are we in for another round of changes in the world of property tax in Scotland?

Why was LBTT Introduced?

Responsibility for property taxation was devolved to Scotland following the Scotland Act which received Royal Assent in May 2012. As a result, following consultation LBTT replaced the old Stamp Duty system in Scotland from 1 April 2015.

The change to LBTT was meant to achieve two main aims:

- To remove some of the large ‘jumps’ in tax that used to occur under the old Stamp Duty bands;

- To reduce the amount of tax paid by buyers at the lower end of the market and, consequently, increase the amount of tax paid by those purchasing larger homes.

Why is There a Need to Change LBTT?

LBTT may only have been in place for a little over two years, but before it was even introduced the new tax was the subject of criticism from some quarters. The main objection was that the revised bands meant that the tax started to increase too quickly and too far down the ladder.

In simple terms it was feared that the increased tax burden on those buying larger properties was too great meaning that it would have a negative impact on the number of larger homes being bought. This would both reduce the amount of tax being paid and have a detrimental effect on the market as a whole by making it harder for people to move up the property ladder.

Since the introduction of LBTT the results seem to have borne this out, with sales at the upper end of the market being notably more sluggish over the last 18 months.

If we look at the difference between the tax being paid in Scotland to that paid on a property elsewhere in the UK, we can see why this might be the case.

Comparison of LBTT and Stamp Duty

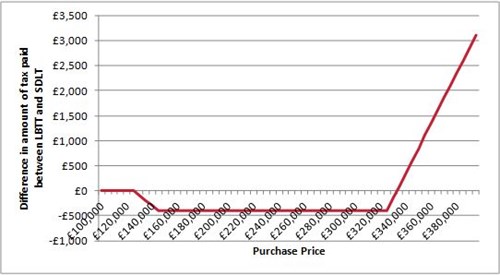

The above chart shows, for a range of purchase price, the difference in tax paid under LBTT and that which would be paid under Stamp Duty. A negative amount means that the tax paid in Scotland is lower, a positive difference meaning LBTT is higher than Stamp Duty and thus that the tax paid in Scotland is higher than elsewhere in the UK.

As you can see, the amount of tax paid on purchases up to £125,000 is the same. In fact in both cases no tax is payable at all on properties at this level. Between £125,000 and £333,000 you will pay less tax in Scotland, with the saving typically being £400 in most cases.

Above this level, however, the level of tax paid in Scotland is higher than for those buying properties elsewhere in the UK. As you go further up the ladder the differences become substantial. If you’re buying a property at £375,000 in Scotland you’ll incur a tax bill that’s £2,100 higher than would be the case for a similarly priced property in England. By the time you get to the £500,000 mark, LBTT stands at £23,350 - over £8,000 more than the corresponding Stamp Duty charge south of the border.

Why the Higher Rates of LBTT Matter

The initial reaction from many people is that this shouldn’t really matter. After all, if someone’s buying a property at £500,000 “they can probably afford to pay more tax”.

While that reaction might be understandable, in practise there are a number of issues with this line of thinking. In the first instance, LBTT is money that you have to pay up front when you’re buying a property. You can’t spread it over the lifetime of a mortgage and many people – even those with relatively high incomes – won’t have the cash on hand that would be needed to pay the high levels of LBTT they face on higher value properties.

Secondly, in many areas of the country the people buying properties at £400,000 tend not to be the ‘super-rich’ – and certainly not so wealthy that they would be able to incur several thousand pounds worth of additional tax without flinching. In Edinburgh, for example, the average price of a four bedroom house currently stands at £438,723. A property at that price would attract an LBTT bill in excess of £17,000.

Finally, and perhaps most importantly, the fact that you can save a substantial amount of money by buying a similarly priced property in England or Wales means that some buyers may be tempted to simply buy south of the border, further dampening demand for larger properties in Scotland.

So Are We Likely to See a Change?

Derek MacKay, Finance Secretary at Holyrood, has recently indicated that he’s willing to amend LBTT bands again, specifically with a view to raising the upper limit on the 5% band from £325,000 to £500,000. Speaking to the Sunday Times recently he said he was “not an ideologue” on property tax and “if there’s a case that an amendment of the current bands could help stimulate the housing market in that range, and the revenue it raises” that he would consider it.

The door to revision of LBTT bands is clearly open. While on one hand it would be less than ideal to have a third round of changes to property tax in Scotland in fairly short order, implementing change is preferable to continuing with the status quo if it is seen to be having a detrimental effect on the market. Going forward it will be important for the Government to fully assess the impact LBTT has had on sales to ensure that any changes to tax bands best serve the Scottish property market.

If you have any questions about LBTT or any other aspect of buying a property in Scotland, please feel free to get in touch with Warners here, or by calling 0131 662 4747.

Note: All figures for LBTT and Stamp Duty are for illustrative purposes only and are based on residential, freehold properties where the buyer does not own any other property.

< Back