A Round Up of The Latest Local & National House Price Reports

In the early part of 2018 we saw house price growth in the local property market consistently outpacing the rate of growth across the UK. As we recently reported though, there are some tentative signs that the pressure on buyers in Edinburgh and the Lothians is beginning to ease.

There now appear to be further signs of a cooling in the local market as we round up the latest house price reports from the past month.

The Local Picture

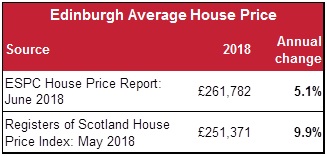

On the face of it the figures from ESPC and Registers of Scotland (RoS) seem to paint very different pictures, with the rate of house price growth reported by RoS almost double that observed by ESPC. Thankfully, there is a simple explanation.

In the first instance, RoS releases their reports one month later than most and as a result their report covers the sales they recorded to end May. The ESPC report covers sales up to the end of June. Secondly, ESPC records sales at the point when an offer is accepted on a property whereas RoS only records a sale when it has concluded and the deed registered.

In short, while the two reports follow similar trends over the long run, the ESPC report offers a more up-to-date picture of what is happening in the market with the RoS report following two or three months behind.

In terms of how we interpret these results, this would suggest that annual inflation in Edinburgh has eased recently. Indeed, we can see that is the case by looking at the annual house price inflation reported by ESPC in their last three reports. Annual inflation in Edinburgh stood at 8.7% and 9.0% in ESPC’s April and May reports respectively. In June, the figure had fallen to 5.1%.

This backs up the what we reported earlier in the month. Buyer demand has eased while the number of properties coming onto the market is higher than at this time last year meaning that house price inflation has started to cool.

UK House Prices

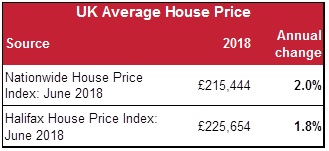

Turning to the national picture, house price growth across the UK is much lower than that which we have seen locally. This has been the case consistently throughout 2018. The picture south of the border has largely been one of a subdued market with activity amongst both buyers and sellers at low levels.

In their latest report, Nationwide’s Chief Economist, Robert Gardener, reported that “surveyors continue to report subdued levels of new buyer enquiries, while the supply of properties on the market remains more of a trickle than a torrent.”

The latest House Price Index from Halifax paints a similar picture. Managing Director Russell Galley commented: “Activity levels, like house price growth, have softened compared with the final months of last year. Mortgage approvals have been in the low range of 63,000 to 67,000 since the start of the year, whilst home sales have remained flat”.

Looking forward, both organisations project that house price inflation will remain at low levels through to the end of 2018. Nationwide “continue to expect house prices to rise by around 1% over the curse of 2018” while Halifax said that current growth is “within our forecast range of 0-3%”.

Rounding Up The Reports

The most significant change that we have seen lately has been that at a local level we are finally starting to see house price growth cooling off. It is never wise to place too much emphasis on one month’s figures of course, but we have been anticipating that house prices will start to ease for some time now.

The rate of growth that we saw in Edinburgh early in the year stemmed from a lack of properties on the market. Typically this situation can only last for so long. When demand exceeds supply for a period of time, rising house prices will tempt some homeowners to put their own property on the market.

Other sellers who delayed putting their property onto the market until they found a property that they wish to buy will decide that they need to take the plunge and sell first to put them in a stronger position when they are offering for their next home.

As a result, while there may be some volatility from month-to-month, we continue to expect that the supply of properties to the local market will improve. This will ease the pressure on buyers during the second half of 2018 and bring local house price inflation back to more sustainable levels.

< Back