What’s in store for the property market in Edinburgh & Lothians in 2023?

For the last three years, the property market in Edinburgh and the Lothians has seen almost unprecedented levels of both activity and upheaval. Against a backdrop that has included a global pandemic, nationwide lockdowns and rising inflation, demand from homebuyers has consistently been at levels not seen since before the economic crisis in 2008. As we move into 2023, the inevitable question is whether this pattern will continue, and what will happen to house prices in Edinburgh, East Lothian, Midlothian and West Lothian.

A Look Back at House Prices in Edinburgh & Lothians in 2022

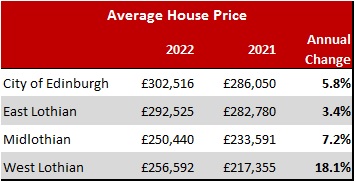

Before turning our attention to 2023, it’s important to look at what happened to market activity in 2022, and how this changed as the year progressed. The headline figures for 2022 paint a very positive picture for those who were looking to sell a home. The average house price rose in each region of Edinburgh and the Lothians, with the average house price in Edinburgh itself passing the £300,000 mark for the first time on record. West Lothian saw the sharpest rise in house prices with the relative affordability of properties in the area attracting many buyers who may previously have bought within the capital.

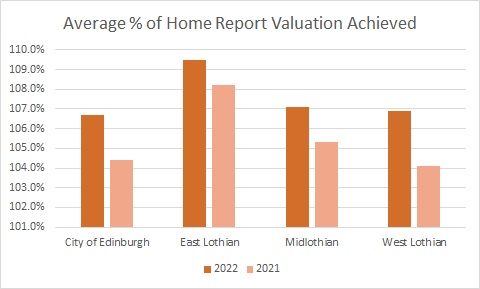

Looking at how much over Home Report valuation properties sold for in 2022, we see further evidence of a seller’s market. In all areas the average premium required to secure a property exceeded 6%, and in each case the average premium was higher than that recorded in 2021.

Although the overall picture in 2022 shows that the market was incredibly favourable for sellers, as it was in 2021, as the year progressed there were signs of greater balance coming to the market as the year progressed. The main driver of the rapid price growth in 2022, and indeed during the two years prior to that, was the incredibly high level of demand from buyers. The supply of properties coming onto the market was simply not sufficient to keep pace with demand. As a result there were typically multiple buyers competing for each property, meaning buyers often had to bid well in excess of Home Report valuation to secure a home.

A steady improvement in the number of properties coming onto the market over the last two years, coupled with a softening in buyer demand during the second half of 2022, led to better equilibrium between supply and demand. As a result, the average premium paid over Home Report valuation declined during the second half of 2022. For example in Edinburgh the average premium in December was 4.1% having peaked at almost 9% in July.

What Will Happen to the Property Market in 2023

A number of factors combined to quell buyer demand during the second half of 2022. Rapid inflation has pushed up the cost of living, reducing the disposable income for most households. In response to the high rate of inflation, the Bank of England’s base rate was increased from just 0.25% at the start of 2022 to 3.5% today. This in turn led to an increase in the interest rates associated with mortgages, further reducing the buying power of those looking to purchase a home.

Although the rate of CPI inflation is likely to ease somewhat in 2023 it will remain well ahead of the target level of 2.0%. As a result, there is little expectation that the cost of borrowing will come down significantly from current levels.

We can reasonably anticipate that buyer demand will thus not return to the extreme highs seen during 2021 and the first half of 2022. The more modest levels of demand that we saw towards the end of 2022 are likely to continue this year and as a result, selling prices in the Edinburgh and the Lothians should come back down in line with Home Report valuations.

In the first instance, this will be welcome news for first time buyers. Mortgage providers will only lend up to the Home Report valuation of a property meaning that, if you want to offer more than the valuation figure for a property, you will need to have that cash on hand in addition to your deposit which presents a significant hurdle for many people looking to get their first foot on the property ladder. Those looking to move up the property ladder also stand to benefit as, whilst they may not achieve as high a price for their current home as would have been the case at the peak of the market last summer, they should be able to secure their new home for less than would have previously been the case.

With regards to the number of homes changing hands, we would anticipate that this will return to what was considered normal market levels prior to the pandemic. Property sales spiked in 2021 following the easing of lockdown restrictions, driven in part by a desire from many home movers to secure a property with an outdoor space. This initial wave of activity has eased however and both seller and buyer enquiries are now more in line with the levels seen in 2019.

If you are thinking of buying or selling a property in Edinburgh, the Lothians or Fife, or have questions about the property market, get in touch with Warners today on 0131 662 4747, or by email at property@warnersllp.com and one of our team will be delighted to help.

< Back